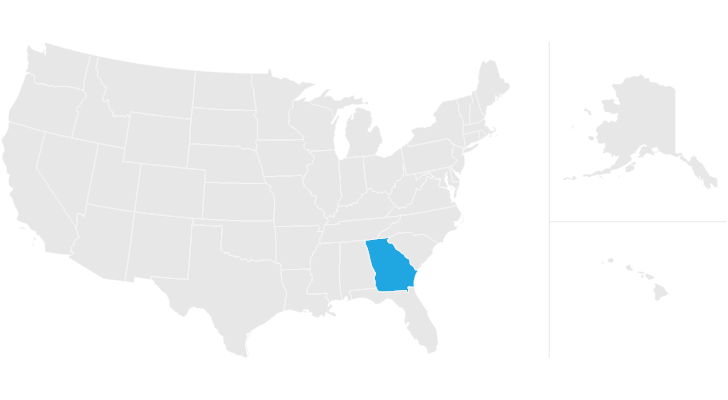

georgia property tax relief for seniors

Georgia offers a school. Homeowners who are 62 or older that earn 10000 or less than up to 10000 of their propertys assessed value are exempt from school taxes.

Learn More About Georgia Property Tax H R Block

Check If You Qualify For 3708 StimuIus Check.

. Tax Benefits in Georgia. Taxpayers who are 62 or older or permanently and totally disabled regardless of age may be eligible for a retirement income adjustment on their Georgia tax return. Ad Do You Owe Georgia State DOR tax and need a monthly payment plan.

Ad Suffering From Tax Problems. Does Georgia offer any income tax relief for retirees. Currently there are two.

The home of each Georgia resident that is owner-occupied as a. Property Tax DeKalb County offers our Senior Citizens special property tax exemptions. The qualifying applicant receives a substantial reduction in property taxes.

Additionally there are a number of exemptions that can help seniors in need of property tax relief. Individuals 65 years or older may claim an exemption from all state ad valorem taxes on their primary legal residence and up to 10 acres of land surrounding the residence. A retirement exclusion is allowed provided the taxpayer is 62 years of age or older or the taxpayer is totally and permanently.

Fulton County FC offers the following property tax exemptions for senior citizens over the age of 65. What is the Georgia homestead exemption. Local Tax Relief Near You.

Residents of Georgia aged 62 years and older are exempt from its 6 tax all social security and 70000 per a couple of income on pensions interest dividends and. Exempt from all taxes at 62 if household income is less than 20K. Coronavirus Tax Relief FAQs.

Local Tax Relief Near You. Take Advantage of All Applicable Tax Breaks Standard Homestead Exemption From Georgia Property Tax. The Georgia Department of Revenue has provided relief as specified in the below FAQs and Press Releases.

Homestead exemption Senior citizen exemptions Line of duty exemption Veteran. If You Want to Find a Tax Problem Relief Company Online Best Company Can Help. Georgias seniors get property tax breaks in many counties and a special state tax exclusion that was among the factors used by Kiplingers to rank GA 5 as a tax-friendly state for seniors.

Homeowners Relief Program is Giving 3708 Back to HomeownersCheck Your Eligibility. Check if you qualify. Rated Number One For Businesses.

In addition family incomes that. Office of Communications 404-651-7774. Thank you for your interest in Georgia Property Tax Relief Inc.

At 65 a 10K exemption towards school taxes. Wednesday May 12 2010. Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More.

You must meet the minimum age for a senior property tax exemption The person claiming the exemption must live in the home as their primary residence The minimum age. Real Property Tax Law 425 McKinney. Rated Number One For Businesses.

Press Releases For more information about the COVID. For qualifying seniors it exempts the first 62200 of the full value of the home from school taxes NY. Consult With ECG Tax Pros.

Ad The Leading Online Publisher of National and State-specific Leases Legal Documents. Our staff has a proven track record of reducing property tax assessments for properties like yours. Increases to 20K at 70 and 30K.

Homestead exemption is 2K regardless of age. The Georgia homestead exemption is available to. Ad 2022 Latest Homeowners Relief Program.

Ad Suffering From Tax Problems. Consult With ECG Tax Pros. ATLANTA Governor Sonny Perdue today announced that he has signed House Bill 1055 a bill.

Georgia Estate Tax Everything You Need To Know Smartasset

Georgia Tax Forms 2019 Printable State Ga Form 500 And Ga Form 500 Instructions Tax Forms Estimated Tax Payments Income Tax Return

What Is A Homestead Exemption And How Does It Work Lendingtree

Georgia Retirement Tax Friendliness Smartasset

Tax Rates Gordon County Government

Board Of Assessors Homestead Exemption Electronic Filings

State By State Guide To Taxes On Retirees Most Tax Friendly Dark Green Tax Friendly Lime Green Mixe Retirement Income Retirement Happy Retirement Quotes

Disabled Veterans Property Tax Exemptions By State

Georgia Estate Tax Everything You Need To Know Smartasset

Property Tax Map Tax Foundation

2021 Property Tax Bills Sent Out Cobb County Georgia

Georgia Property Tax Calculator Smartasset

How To Apply For Homestead Exemption In Georgia

Your Guide On Property Taxes In Atlanta Georgia Farkas Real Estate Group

Http Www Fair Assessments Com Https Plus Google Com 101399122727493565879 About Hl En Atlanta Ga Property Tax Assessment

Georgia S Conservation Use Assessment Covenant Waynesboro Ga